Precision medicine

-

DATABASE (44)

-

ARTICLES (89)

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

One of China’s biggest medicine delivery unicorns, Dingdang offers 24/7 AI-robo service and consultation, offline smart pharmacies, and delivery in under 30 minutes.

One of China’s biggest medicine delivery unicorns, Dingdang offers 24/7 AI-robo service and consultation, offline smart pharmacies, and delivery in under 30 minutes.

CMO and Co-founder of Evja

Paolo Iasevoli has over 15 years of international experience in the digital sector across Italy, Germany and Luxembourg.Iasevoli is the CMO and co-founder of Evja, a pioneering Italian startup in the agri-tech sector that uses sensors, advanced agronomic models and AI-powered SaaS for precision farming.

Paolo Iasevoli has over 15 years of international experience in the digital sector across Italy, Germany and Luxembourg.Iasevoli is the CMO and co-founder of Evja, a pioneering Italian startup in the agri-tech sector that uses sensors, advanced agronomic models and AI-powered SaaS for precision farming.

CEO and Co-founder of Evja

Davide Parisi is the CEO and co-founder of Evja, a pioneering Italian startup in the agritech sector that combines sensors, advanced agronomic models and AI-powered SaaS for precision farming. Prior to Evja, Parisi worked as a project manager and business developer in Spanish startups in the AR sector.

Davide Parisi is the CEO and co-founder of Evja, a pioneering Italian startup in the agritech sector that combines sensors, advanced agronomic models and AI-powered SaaS for precision farming. Prior to Evja, Parisi worked as a project manager and business developer in Spanish startups in the AR sector.

CTO and Co-founder of Evja

Antonio Affinito, is an Italian electronic engineer with over 15 years of experience in radar system engineering at Leonardo Finmeccanica.Since 2015, he’s been the CTO of Evja, a pioneering Italian startup in the agritech sector that combines sensors, advanced agronomic models and AI-powered SaaS for precision farming.

Antonio Affinito, is an Italian electronic engineer with over 15 years of experience in radar system engineering at Leonardo Finmeccanica.Since 2015, he’s been the CTO of Evja, a pioneering Italian startup in the agritech sector that combines sensors, advanced agronomic models and AI-powered SaaS for precision farming.

CMO and co-founder of Biel Glasses

Since 2017, Constanza Lucero has been the co-founder and Chief Medical Officer at Biel Glasses, a medtech startup offering relief to people with low vision. She is the mother of Biel, who was born with low vision and the impetus for the startup. She also works at Badalona Hospital as a Specialist in Internal Medicine in its Accidents and Emergencies Department. Prior to this, she worked for nine years at Barcelona's Hospital Clinic as a Specialist in Infectious Diseases, HIV and Internal Medicine. Lucero holds a Doctorate of Medicine from the University of Barcelona as well as a master's in Clinical Research from the same institution.

Since 2017, Constanza Lucero has been the co-founder and Chief Medical Officer at Biel Glasses, a medtech startup offering relief to people with low vision. She is the mother of Biel, who was born with low vision and the impetus for the startup. She also works at Badalona Hospital as a Specialist in Internal Medicine in its Accidents and Emergencies Department. Prior to this, she worked for nine years at Barcelona's Hospital Clinic as a Specialist in Infectious Diseases, HIV and Internal Medicine. Lucero holds a Doctorate of Medicine from the University of Barcelona as well as a master's in Clinical Research from the same institution.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

Co-founder and CEO of Zhuojian

Undergrad medicine, Zhejiang University; PhD, Medical University of South Carolina. Former surgeon at First Affiliated Hospital of Zhejiang University.

Undergrad medicine, Zhejiang University; PhD, Medical University of South Carolina. Former surgeon at First Affiliated Hospital of Zhejiang University.

Founder and CEO of Halodoc

Jonathan Sudharta is the son of Sudharta, the founder of pharmaceutical conglomerate Mensa Group. He graduated from Curtin University, Australia with a bachelor's in Economics, specializing in electronic commerce. Jonathan has since helped to expand his family business, building a social media network for doctors and developing ApotikAntar, a service for delivering medicine from licensed pharmacies to customers. In 2016, he combined the medicine delivery service and online interaction with doctors to create Halodoc, a healthcare platform startup backed by the Mensa Group.

Jonathan Sudharta is the son of Sudharta, the founder of pharmaceutical conglomerate Mensa Group. He graduated from Curtin University, Australia with a bachelor's in Economics, specializing in electronic commerce. Jonathan has since helped to expand his family business, building a social media network for doctors and developing ApotikAntar, a service for delivering medicine from licensed pharmacies to customers. In 2016, he combined the medicine delivery service and online interaction with doctors to create Halodoc, a healthcare platform startup backed by the Mensa Group.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Chairman and Founder of Dingdang Medicine Express

Born in Jiangxi Province in 1962, Yang Wenlong is a traditional Chinese pharmacist and senior economist. The MBA graduate from Cheung Kong Graduate School of Business ran a traditional Chinese medicine business from 1982 to 1987 in Zhangshu. He also founded the Jiangxi Kangmei Medical & Healthcare Co Ltd in 1998 and the Renhe Group in 2001.He is the chairman of Renhe Group and Dingdang Medicine Express. He is a member of the national committee of the Chinese People's Political Consultative Conference (CPPCC) and a member of the central committee of the China National Democratic Construction Association.

Born in Jiangxi Province in 1962, Yang Wenlong is a traditional Chinese pharmacist and senior economist. The MBA graduate from Cheung Kong Graduate School of Business ran a traditional Chinese medicine business from 1982 to 1987 in Zhangshu. He also founded the Jiangxi Kangmei Medical & Healthcare Co Ltd in 1998 and the Renhe Group in 2001.He is the chairman of Renhe Group and Dingdang Medicine Express. He is a member of the national committee of the Chinese People's Political Consultative Conference (CPPCC) and a member of the central committee of the China National Democratic Construction Association.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

The Bank of China is one of four major state-owned banks in China. It provides financial services to China as well as 51 other countries and regions. The BOC makes direct investments and conducts investment management through its wholly owned subsidiary Bank of China Group Investment Ltd. It invests primarily in its clients and focuses on the fields of finance, consumption, medicine and energy sources.

iLoF: Accelerating access to personalized medicine, from a drop of blood

Backed by Microsoft’s venture fund M12, Mayfield and Melinda Gates’s Pivotal Ventures, iLoF focuses on painless screening to facilitate disease detection, forecasting and drug development, from Alzheimer’s to Covid-19

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

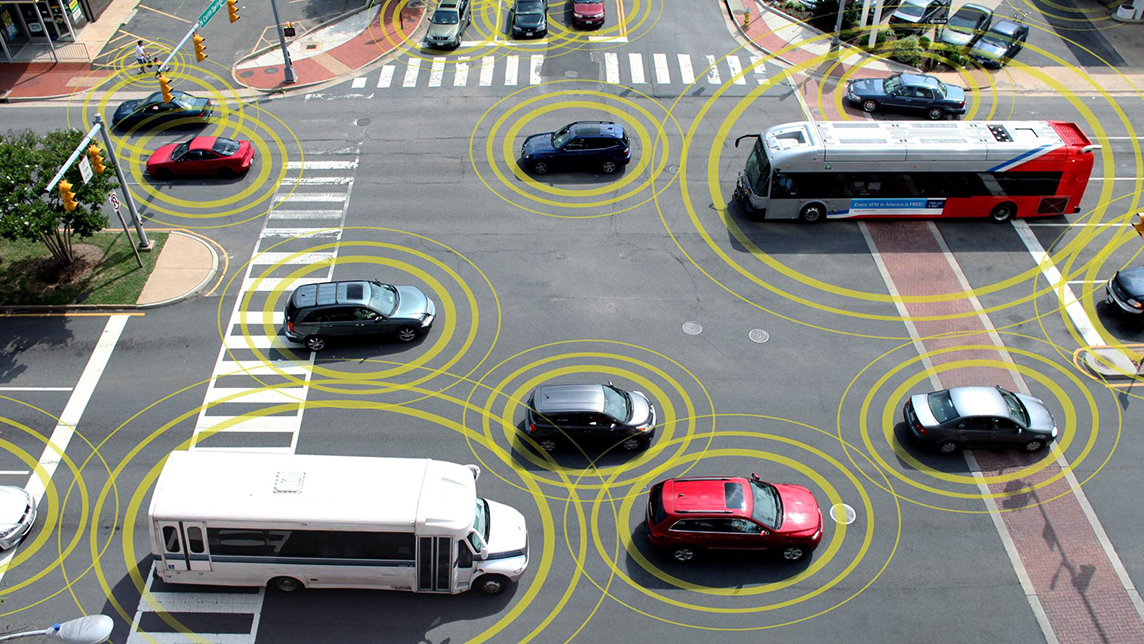

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

QinLin Tech gets advertisers to pay for your local security systems

Besides keeping residents safe from intruders, QinLin’s smart community business model also offers essential home services, social activities and group-buying discounts

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

TMiRob's medical robots lighten the load of doctors and nurses in hospitals

The robots also reach an operating room three minutes faster than human nurses – that's more time for saving lives

From Naples to Dhaka: Italo-Dutch precision farming startup Evja eyes funding for R&D, sales boost

Evja has a second office in the Dutch “Food Valley” and is investing to boost its advanced agronomic modeling, to stave off rising competition

UpHill: Helping doctors put the latest research into practice

Born out of practitioners’ difficulty in keeping up with latest treatments and protocols, UpHill now includes guidance on Covid-19

For crop pest control, McFly does all the thinking

Chinese agtech startup McFly deploys data-driven crop health and pesticide monitoring systems so farmers get higher-quality yields and less wastage

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

SWITCH Singapore 2021: Benefits and challenges of AI applications in healthcare

Medical experts and healthcare startups agree AI can contribute more to healthcare beyond improving diagnosis and personalized treatment, but hurdles still remain

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

Sorry, we couldn’t find any matches for“Precision medicine”.